so download a complete code in my google drive please

Click and download the code

required packages : quantmod / PerformanceAnalytics

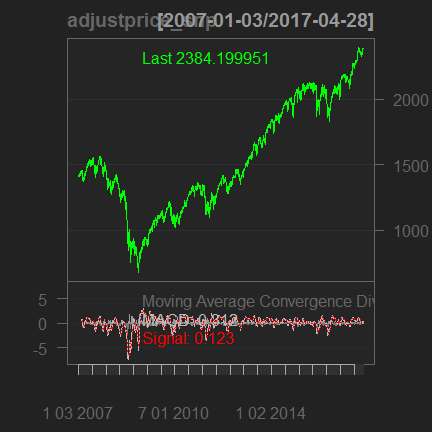

1) collect data, S&P 500 index

snp <- auto.assign="FALSE)</p" getsymbols="" src="yahoo">

2) take only adjust price

adjustprice_snp<-snp -snp="" p="">

3) Draw MACD chart

chartSeries(adjustprice_snp, TA="addMACD()")

4) adjust variable in macd analysis

macd =

MACD(adjustprice_snp, nFast=15, nSlow=30,nSig=9,maType=SMA, percent = FALSE)

5) create trading signal

signal = Lag(ifelse(macd$macd>=macd$signal, 1,0))

-get rid of lookahead bias by lagging

-trade based on signal

6) calculate return

ret = ROC(adjustprice_snp)*signal

7) set time

ret = ret['2009-01-01/2017-01-10']

8) calculate cumulative return

portCumRet = exp(cumsum(ret))

plot(portCumRet)

9) evaluate risk

#check worst 10 period and downside risk

table.Drawdowns(ret,top=10)

table.DownsideRisk(ret)

5) create trading signal

signal = Lag(ifelse(macd$macd>=macd$signal, 1,0))

-get rid of lookahead bias by lagging

-trade based on signal

6) calculate return

ret = ROC(adjustprice_snp)*signal

7) set time

ret = ret['2009-01-01/2017-01-10']

8) calculate cumulative return

portCumRet = exp(cumsum(ret))

plot(portCumRet)

9) evaluate risk

#check worst 10 period and downside risk

table.Drawdowns(ret,top=10)

table.DownsideRisk(ret)

charts.PerformanceSummary(ret)

#other functions for technical analysis including MACD

addADX

add Welles Wilder's Directional Movement Indicator*

addATR

add Average True Range *

addBBands:

add Bollinger Bands *

addCCI

add Commodity Channel Index *

addCMF

add Chaiken Money Flow *

addCMO

add Chande Momentum Oscillator *

addDEMA

add Double Exponential Moving Average *

addDPO

add Detrended Price Oscillator *

addEMA

add Exponential Moving Average *

addEnvelope

add Moving Average Envelope

addEVWMA

add Exponential Volume Weighted Moving Average *

addExpiry

add options or futures expiration lines

addLines

add line(s)

addMACD:

add Moving Average Convergence Divergence *

addMomentum

add Momentum *

addPoints

add point(s)

addROC:

add Rate of Change *

addRSI

add Relative Strength Indicator *

addSAR

add Parabolic SAR *

addSMA

add Simple Moving Average *

addSMI

add Stochastic Momentum Index *

addTRIX

add Triple Smoothed Exponential Oscillator *

addVo:

add Volume if available

addWMA

add Weighted Moving Average *

addWPR

add Williams Percent R *

addZLEMA

-reference-

http://blog.naver.com/htk1019/220908871667

#other functions for technical analysis including MACD

addADX

add Welles Wilder's Directional Movement Indicator*

addATR

add Average True Range *

addBBands:

add Bollinger Bands *

addCCI

add Commodity Channel Index *

addCMF

add Chaiken Money Flow *

addCMO

add Chande Momentum Oscillator *

addDEMA

add Double Exponential Moving Average *

addDPO

add Detrended Price Oscillator *

addEMA

add Exponential Moving Average *

addEnvelope

add Moving Average Envelope

addEVWMA

add Exponential Volume Weighted Moving Average *

addExpiry

add options or futures expiration lines

addLines

add line(s)

addMACD:

add Moving Average Convergence Divergence *

addMomentum

add Momentum *

addPoints

add point(s)

addROC:

add Rate of Change *

addRSI

add Relative Strength Indicator *

addSAR

add Parabolic SAR *

addSMA

add Simple Moving Average *

addSMI

add Stochastic Momentum Index *

addTRIX

add Triple Smoothed Exponential Oscillator *

addVo:

add Volume if available

addWMA

add Weighted Moving Average *

addWPR

add Williams Percent R *

addZLEMA

-reference-

http://blog.naver.com/htk1019/220908871667

0 Comment to "Technical Analysis in R (addMACD)"

Post a Comment